Social

Achievements Related to Fiduciary Duties

Action Plans and Achievements

-

1.Selling and providing customer-centric products and services

-

(1)Providing value-added, attractive products and services

- Action plan

-

- We will support our customers' asset building by providing value-added, attractive products and services with use of cutting-edge technologies.

- Achievements

-

We have assisted our customers in building their assets by providing value-added, attractive products and services, using the Internet and other innovative technologies.

Our major initiatives include the followings.

- We provide foreign currency deposits/savings accounts at attractive levels of interest and exchange rates on transactions.

- We have run a special campaign offering yen time deposits at attractive interest rates.

- The use of NEOBANK Platform that opens up our products and services to partner companies is expanding.

- Since the launch of our NEOBANK Platform in April 2020 with JAL Payment Port Co., Ltd. (a group company of Japan Airlines Co., Ltd.), we have partnered with YAMADA FINANCE SERVICE Co., Ltd. (a group company of YAMADA HOLDINGS CO., LTD.), Takashimaya Company, Limited, The Dai-ichi Life Insurance Company, Limited, and Fighters Sports & Entertainment Co., Ltd. and others for our NEOBANK service. As of the end of April 2024, we have established partnerships with as many as 16 companies.

- Our partnerships are not limited to the airline, retail, financial, and housing industries. We have initiated and are discussing partnerships for our NEOBANK service with a variety of different industries, including professional sports organizations , the railroad industry and Infrastructure Industry (planning).The number of accounts is increasing steadily by providing customers with attractive products and services such as Pay settlement and accumulation functions.

-

(2)Stably providing products and services

- Action plan

-

- We will bring to our customers the convenience and ease of having an internet bank, with which they can transact at any time, by stably operating online transaction systems and building a robust security environment.

- Achievements

-

- We have continued activities a robust security environment by implementing a security roadmap as well as an activity plan based on regular assessment of cybersecurity risks and knowledge of security vendors. As a result of these activities, we have had no serious security incident like a system breakdown or information leak caused by a cyberattack, providing secure services to our customers.

- We have established a system that can promptly restore service in the event of a major system failure by actively utilizing cloud services and expanding our system backup center. At the same time, we are constantly improving the quality of our systems by thoroughly standardizing system development, verifying development deliverables by multiple people, and implementing measures to prevent recurrence of system incidents.

- In order to stably provide products and services, we are committed to building a control environment to prevent system failures and maintain consistent system quality by, for example, monitoring the operational status and performance of systems on an ongoing basis, with the System Risk Management Committee, in which the management including the President and CEO participate, leading the effort.

-

(3)Enhancing our website and smartphone app, and other customer interfaces, providing easy-to-understand information for customers

- Action plan

-

- We will sincerely listen to customer voices about our website, smartphone app, and other customer interfaces, and make continuous improvements from the perspectives of ease in viewing, using, and understanding them.

- In sales and intermediary of financial products that entail complex risks for our customers*, we will provide easy-to-understand explanations on such products’ characteristics, risks, fees, and other relevant aspects, posting them on our website and smartphone app in an easy-to-view place, to aid customers’ selections.

- *Foreign currency deposits, structured deposits, investment trusts, insurance, robo-advisory services (automated asset management services)

- When a bank agency having us as the principal bank sells or otherwise handles products, we will seek to provide easy-to-understand explanations and information to help customers understand the details of the product.

- To relevant customers such as those who have foreign currency deposits, we will work to provide information that would help them increase their financial transactions, such as by sending emails at times such as when exchange rates are expected to fluctuate.

- Achievements

-

- We have made continuous improvements to our website and smartphone app from the perspectives of ease in viewing, using, and understanding these customer interfaces. Also, we have improved the NEOBANK Platform to enable seamless banking transactions using smartphone apps of our partner companies.

- We collect customer voices, such as complaints and requests, via the dedicated form on our website, discuss response measures and make improvements, prioritizing frequently mentioned and/or significant matters.

- Major responses to customer requests include: UI improvements to app and web home and Amendment to such as automatic deposit and hybrid deposit service.

- As for financial products that entail complex risks for customers, we seek to provide information that would enable customers to correctly understand the products, including fees to be borne by customers, paying attention to the ease of understanding by standardizing posting places and expressions.

-

(4)Managing conflicts of interest

- Action plan

-

- We will identify conflicts of interest associated with transactions with customers, the status of which our risk management unit will monitor on a regular basis, and appropriately manage such conflicts based on the monitoring results.

- Achievements

-

- We have continued our operation of identifying conflicts of interest associated with transactions with customers, with our risk management unit regularly monitoring the state of such conflicts of interest and reporting the monitoring results to the board of directors.

- To provide information that help our customers understand this operation, we have published “Overview of Policy on Managing Conflicts of Interest” on our website.

-

- ※Given the nature of our business to provide financial products and services using internet channels (internet bank), we do not have action plans for these Principles (Principle 5 (part of Note 1) and Principle 6 (Note 1)). In addition, since we neither structure financial products nor sell or recommend multiple products and services as a package, our action plans do not cover these Principles (Principle 5 (Note 2), Principle 6 (Notes 2 and 3)).

-

-

2.Developing and providing products and services that meet varied needs of customers

-

(1)Developing and providing attractive products and services, aiming for the creation of new customer experiences and new values

- Action plan

-

- We will actively promote the use of technologies and open up APIs to develop and provide financial services that would contribute to greater convenience and asset building of customers.

- We will vigorously accumulate know-how and experience in artificial intelligence, aiming to transform and increase the convenience of financial services that we provide to customers.

- Achievements

-

- To ensure safer transactions for our customers, we have introduced a personal authentication service called 'LIQUID Auth' to prevent fraudulent impersonation online.

- In response to numerous requests from our customers, we have introduced 'Pay-easy' service to enable the payment of taxes and social insurance premiums via computers and smartphones.

- We actively use internally-developed artificial intelligence in various fields including credit limit, marketing, fraud detection, and responding to customer inquiries.

- As of the end of April 2024, our NEOBANK Platform was provided to 16 partner companies, and we continue to actively promote partnerships.

-

(2)Reflecting customer voices

- Action plan

-

- We will seek to achieve customer centricity through continuous improvements in services based on views of customers received by our Customer Support Center and bank agencies whose principal bank is us, as well as the results of customer satisfaction surveys conducted by external evaluation organizations.

- Achievements

-

- We held meetings such as the SDGs/ESG Management Promotion Liaison Committee chaired by the President and CEO and other meeting bodies for discussing responses after collecting and analyzing the results of customer satisfaction surveys conducted by external evaluation organizations, as well as customer voices received by our Customer Support Center and bank agencies whose principal bank is us. Thus, our officers and employees have driven forward initiatives for reflecting these into continuous improvements in our services as ever.

-

(3)Contribution to society

- Action plan

-

- We will continue our initiatives to introduce state-of-art fintech and other financing technologies to the next generation through financial education for young people such as high school and university students. Also, we will use the next generation’s voices to pioneer new fields for the near future of the financial industry.

- Achievements

-

We have implemented initiatives to introduce state-of-art fintech and other financing technologies to the next generation through financial education for high-school and university students.

The state of specific initiatives is as follows.

-

Initiatives for high-school students

We participated in the operation of the online tournament and the national tournament of the 17th National High School Financial and Economics Quiz Tournament “Economics Koshien.” We have been engaged in the operation of the tournament consecutively since the 7th tournament held in 2012.

In addition, we have prepared videos as teaching materials on how to manage money as well as how to invest in products such as foreign currencies and points to note in making such investments, thus teaching about 12,000 high-school students across Japan through teachers who requested to use the materials in classes. - Initiatives for university students We have provided endowed courses and internship opportunities on the theme of fintech.

-

Initiatives for high-school students

-

-

3.Initiatives for practicing and spreading awareness of fiduciary duties

-

(1)Conducting customer surveys on their attitudes toward us

- Action plan

-

- We will regularly conduct customer surveys on their attitudes toward us, using external evaluation organizations.

- Achievements

-

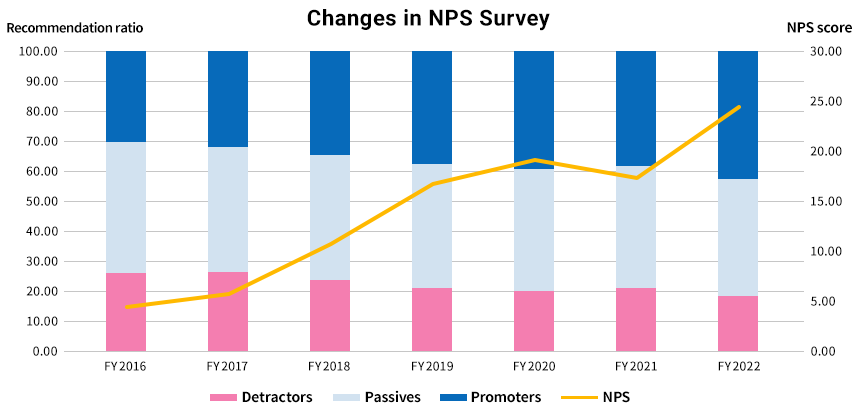

- In addition to receiving reports on surveys conducted by external evaluation organizations, we have conducted semiannual awareness surveys, using NPS (Net Promoter Score*), on customers who have accounts with us (between July 21st and 31st of 2023, and between January 19th and 29th of 2024. FY2023 internal awareness survey results** show that our NPS was 29.1, continuously improving from NPS4.4 in November 2016 when the survey started. We believe our initiatives have been reasonably appreciated.

- *NPS is the percentage of customers who scored 9 or 10 and are likely to recommend us minus the percentage of those who scored 0 to 6, in answers on a scale of 0 to 10. Net Promoter® and NPS® are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems Inc (current NICE Systems, Inc.).

- **Survey summary/target: The survey is held online. Survey targets are SBI Sumitomo Trust Bank retail account holders who have logged in at least once during the six months prior to the start of the survey who can receive emails (targets up to FY2020 were SBI Sumitomo Trust Bank retail account holders who can receive emails)

-

(2)Conducting training and performance evaluation for spreading awareness of fiduciary duties

- Action plan

-

- We will implement internal training and other initiatives using the results of customer attitude surveys to continue the practice of customer-oriented business conduct.

- Achievements

-

- We have provided an e-leaning programs during the year for all officers and employees for the purpose of spreading the awareness of fiduciary duties in accordance with “Principles for Customer-Oriented Business Conduct” by the Financial Services Agency of Japan.

-